A comprehensive financial analysis from Broman Sachs, the multinational investment bank and financial services company, has revealed a startling correlation between a wife’s nagging about money and a significant decrease in her husband’s earning potential.

The in-depth study, which analyzed financial and lifestyle data from over 5,000 households across various income brackets, found that each instance of financial nagging could reduce a husband’s annual income by an average of 7.5%. This may seem small, but for husbands who face daily criticism about their spending or earning habits, the impact can be substantial, leading to a potential loss of up to 18.25% of their yearly income. Over a lifetime, this could translate to millions of dollars in lost earnings.

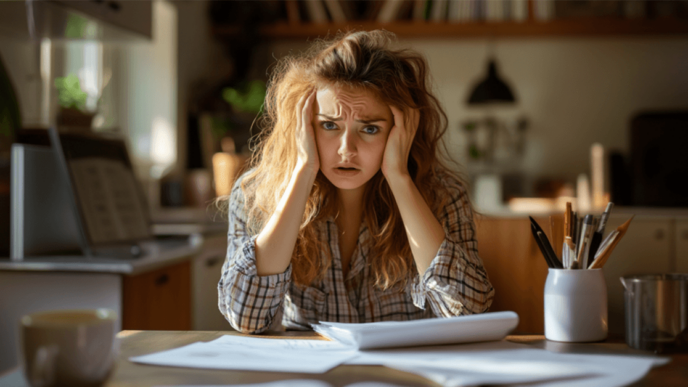

The researchers behind the analysis attribute this financial decline to several factors: The stress and anxiety triggered by constant criticism can lead to a decrease in productivity at work, as well as a higher likelihood of making impulsive financial decisions. The negative atmosphere created at home can also contribute to a decrease in overall well-being, affecting job performance and career advancement opportunities.

Furthermore, the study found that husbands who experience frequent financial nagging were 25% more likely to report feeling demotivated and unappreciated in their jobs, leading to lower job satisfaction and reduced engagement. This, in turn, can hinder career progression and limit earning potential over time.

Broman Sachs advises couples to adopt a more collaborative and supportive approach to managing household finances. Open communication, mutual respect, and a focus on shared financial goals can create a more harmonious and ultimately prosperous environment for both partners. The firm also suggests that wives consider alternative ways to seek contentment in their daily lives, not involving shopping or luxury bags.

The study’s findings serve as a wake-up call for couples who may be inadvertently sabotaging their financial futures through negative communication patterns. By fostering a more positive and supportive financial environment, couples can work together to achieve their long-term financial goals and build a more secure future for themselves and their families.